Get instant loan offer suitable to your profile !

On this Page:

Learn about ICICI Bank education loan disbursement process. Get insights on timelines, required documents, and how to ensure a smooth loan disbursement.

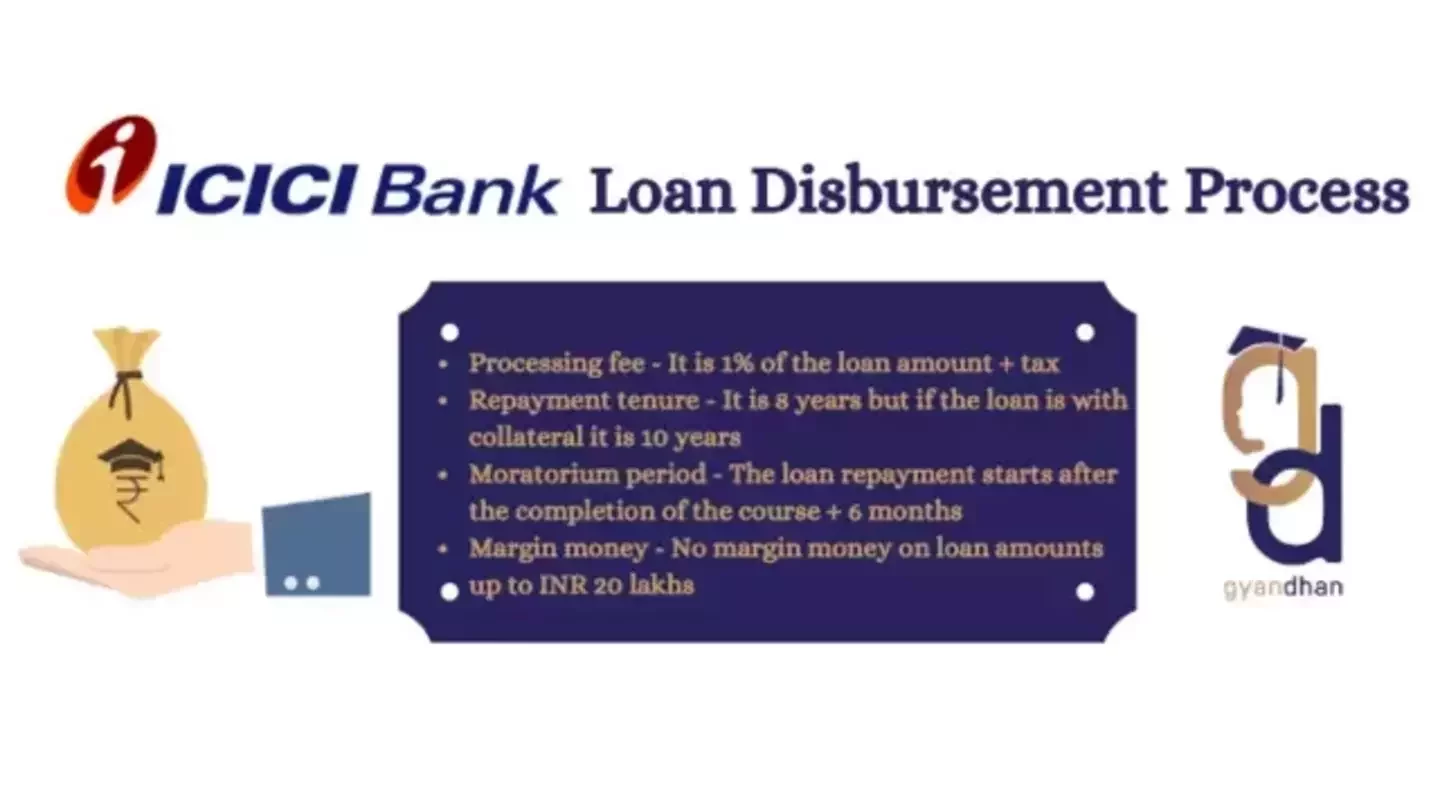

| Feature | Details |

|---|---|

|

Loan Amount |

Up to 50 Lakhs INR (depending on your university/college category) |

|

10.85% - 12.50% |

|

|

Loan Tenure |

Up to 10 years |

|

Processing Fees |

0.5% - 1% of the loan amount + GST |

|

0% - 15% (depending on your university/college category) |

|

|

Course + 6 months |

|

|

ICICI Education Loan Processing Time |

Up to 7 Days |

Now that you have understood the education loan from ICICI Bank features it is time to understand the disbursement process. It is important to understand the disbursement process because there are many sources from which you can get the loan process information but there are very few that have given knowledge on the disbursement process.

The disbursement process is the phase that starts once your loan has been sanctioned. Loan sanction signifies the lender's agreement to grant the requested loan amount to the borrower, indicating loan approval. It does not, however, imply that the funds have been released to the borrower. Further verifications and checks may be performed by the lender before disbursing the loan amount. It is important to note that loan sanction and loan disbursement are two distinct phases of the loan process. Thus, it makes understanding the loan disbursement process equally important.

As the process for education loan ICICI is digital therefore you do not have to undergo many additional steps in order to get your loan disbursed. The simple steps that you would need to follow in order to take the disbursement are as follows -

This is technically not part of the disbursement but is an important step as without it you cannot start your disbursement process. In this step, you have to ensure that you have filled out the ICICI education loan application and provided all the necessary documents for approval purposes.

Once you have submitted all the documents and they have been verified you will get education loan approval via an email notification. In some cases, you will receive a sanction letter but for this, you will have to submit the signed loan agreement first.

You would need to do is to read and sign the loan agreement. In this agreement, you can find the list of documents that are required to be submitted during the disbursement process. After reading the agreement letter, you would have to perform 2 tasks. First, you would be required to collect all the documents that are mentioned in the loan agreement. The second would be to sign the agreement and also get the co-applicant to sign the agreement.

Afterward, you have to contact the ICICI Bank personnel with an application request to disburse the required amount. The amount mentioned in the application will be disbursed accordingly. There is no special disbursement request form. You need to ensure that you ask for disbursement approximately 15 days before tuition fee submission. You can also connect with the same personnel in order to ICICI education loan status.

The disbursement takes place in the following manner -

Just like the list of documents during the application process for an education loan, there are some documents that you may need to submit in order to get the disbursement process initiated. The document list is shown below -

There are several benefits that you may get when getting your loan disbursed from ICICI Bank through GyanDhan. GyanDhan offers assistance throughout the entire process of getting a loan, from the initial stages to the disbursement process. They are available to help with any difficulties that may arise during the disbursement process and have the necessary knowledge to overcome any challenges that may occur, ensuring that they are resolved quickly.

To begin the process of securing funding for your international education, start by checking your loan eligibility for an education loan with GyanDhan. By doing so, you can be confident in utilizing their expertise in the disbursement process to ensure a smooth application process and successful loan disbursement.

Read more about

You will be getting regular updates over email and other suitable communication mediums. Apart from it, you can also see your loan status on GyanDhan’s online dashboard as this has real-time information.

It takes around 5 - 7 days to get the loan sanctioned once all the necessary documents are submitted. The disbursement process however can take upto 15 days once the request and documents have been submitted.

The bank offers the option to get the loan amount disbursed as a way to show proof of funds during the visa interview. The bank also has preferential forex rates for international disbursements.

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat