Get instant loan offer suitable to your profile !

On this Page:

Read GyanDhan’s guide on TCS on education loans and foreign remittance for education loans.

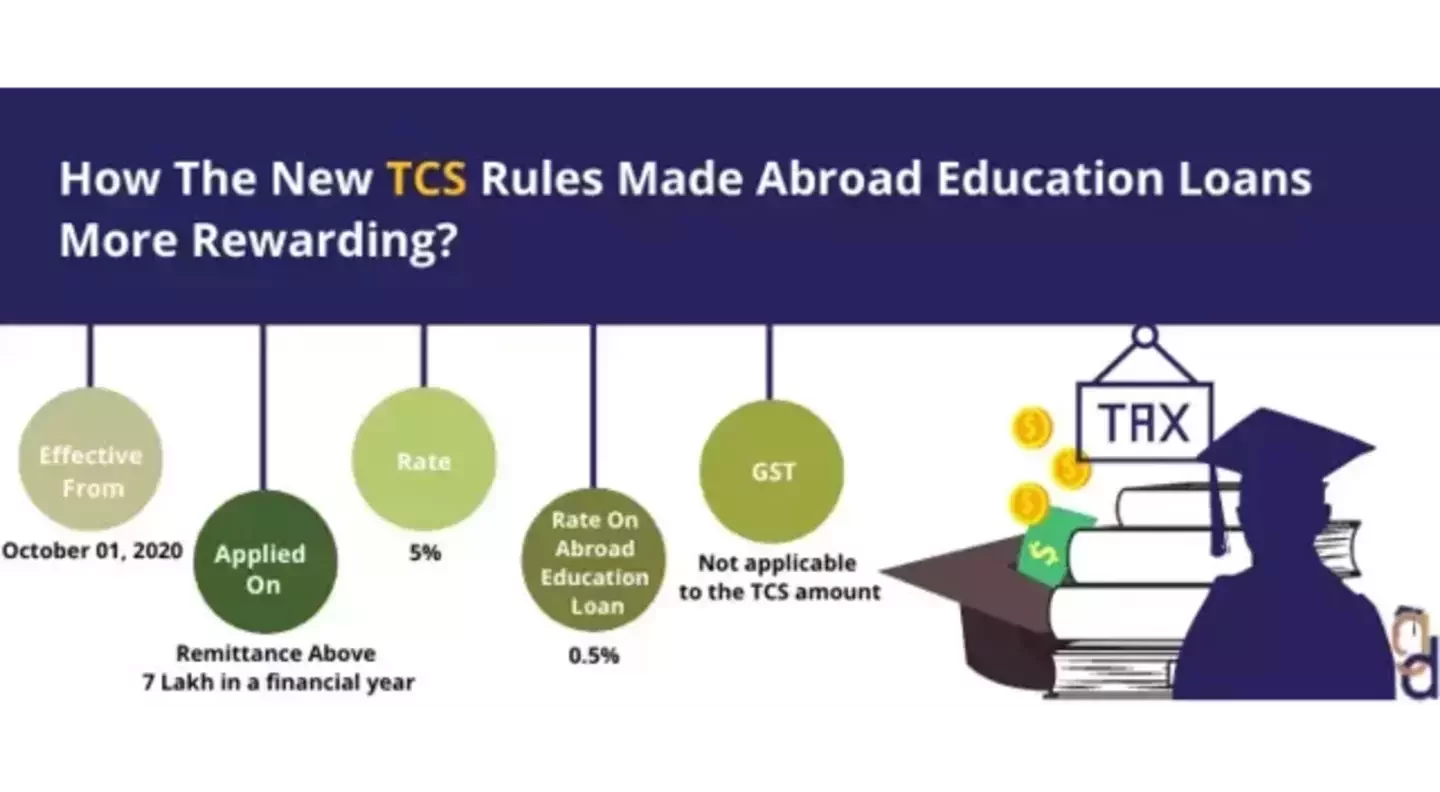

Tax Collection at Source or TCS on education loans makes education loans more rewarding for study-abroad aspirants. No investment can get you a higher return than the one on your education. A smart move for education loans can save you around 4.5% more money than you need to spend for education abroad. Adding to the purely economic reasons to go for an abroad education loan are the TCS on education loan rules introduced by the Government of India in 2020.

Understanding the benefits of education loans over self-funding after the new TCS on education loan rules are crucial for study-abroad aspirants. Also, it is essential to learn about the tax amendment before applying for a loan since the new rule can also be corrected further. Keep reading for an in-depth understanding of TCS on foreign remittance for education loan and how the new education loan TCS rules favor education loans over self-funding for overseas education.

TCS is the additional amount the seller of specified goods gets as tax from the customer to be remitted to the government's account.

To start with some basics, the LRS, under the RBI guidelines, allows an individual to remit up to USD 2,50,000 per financial year (April - March) for education-related expenses as well as investing in the foreign stock markets.

From October 01, 2020 onwards, this new limit is INR 7 Lakh for foreign exchange remittances. This scheme does not apply to corporates, non-resident Indians (NRI), firms, and trusts, among others. In short, it means that if you want to fund your abroad education (which requires certainly more than INR 7 Lakh), the tax on foreign remittance for education you pay is 5% of the amount minus INR 7 Lakh.

The following are the major takeaways from the new education loan TCS rules valuable for an education abroad aspirant:

The tax on education loan is collected only on the remitted amount above INR 7 Lakh. For example, if someone remits INR 10 Lakh in a year, 5% TCS will be calculated on INR 3 Lakh i.e. INR 15,000 will be deducted as TCS.

Now comes why education loans for abroad studies are the best choice over self-funding under the TCS rules:

Given that education abroad is quite expensive, TCS on foreign remittance for education loans can be considerable savings in the amount you need to spend for education abroad. Therefore, students taking an education loan to finance their studies abroad have a notable saving on the tax amount.

Here’s how the new TCS on foreign remittance for education loan rules makes abroad education loans a smart option for students. Only 0.5% TCS applies to the transfer amount of more than INR 7 Lakh if the educational expense is financed through an education loan. However, if the educational funds are not arranged through an education loan, a 5% tax on the amount transferred above INR 7 Lakh will be deducted.

It means that if a student takes financial assistance from anyone other than authorized financial lenders like public sector banks, private banks, and NBFCs, then TCS on education loan will be added to the existing financial burden.

Let us understand it better with an example. Ashok, who is sending INR 12 Lakh to his son studying in America, has to pay a TCS of INR 25,000 (5% of 12 Lakh -7 Lakh) if the funds are not arranged through an education loan. If Ashok's son has taken an education loan for his studies abroad, the applicable TCS on education loan will be INR 2,500 (0.5% of 12 Lakh-7 Lakh).

Since abroad education loans are the best choice to fund abroad studies, here’s where GyanDhan comes to your help. Students can get in touch with us and our education loan counselor will suggest the best education loan options depending upon the overall profile. GyanDhan is an education financing marketplace and has partnered with government banks like SBI, and UBI, private banks like Axis and ICICI, and several NBFCs such as HDFC Credila, Avanse, and more. The entire loan process is online and students can get everything done from the comfort of their home. To start your education loan journey from the comfort of your home, check your loan eligibility now.

No, there is no TCS on foreign remittance for education loans if the total expenditure is below INR 7 Lakh. However, if the remittance exceeds INR 7 Lakh and is financed through a loan from an approved financial institution, a TCS rate of 0.5% will apply to the amount exceeding INR 7 Lakh.

This means that TCS on foreign remittance for education loans is applicable only for amounts above INR 7 Lakh which ensures minimal tax for students using approved loans for foreign education.

If the tax on foreign remittance for education exceeds an individual's tax liability, they can claim a refund by filing their tax return. Once filed, it is advisable to follow up with the tax authorities to confirm the processing and ensure the receipt of the refund for any excess TCS paid.

A 0.5% TCS rate is charged on remittances for educational purposes when financed through a loan from a financial institution. If the tax on foreign remittance for education is not financed by such a loan, a TCS rate of 5% applies.

The tax on foreign remittance for education depends on the total amount sent abroad and whether it is financed through an education loan:

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat