Get instant loan offer suitable to your profile !

On this Page:

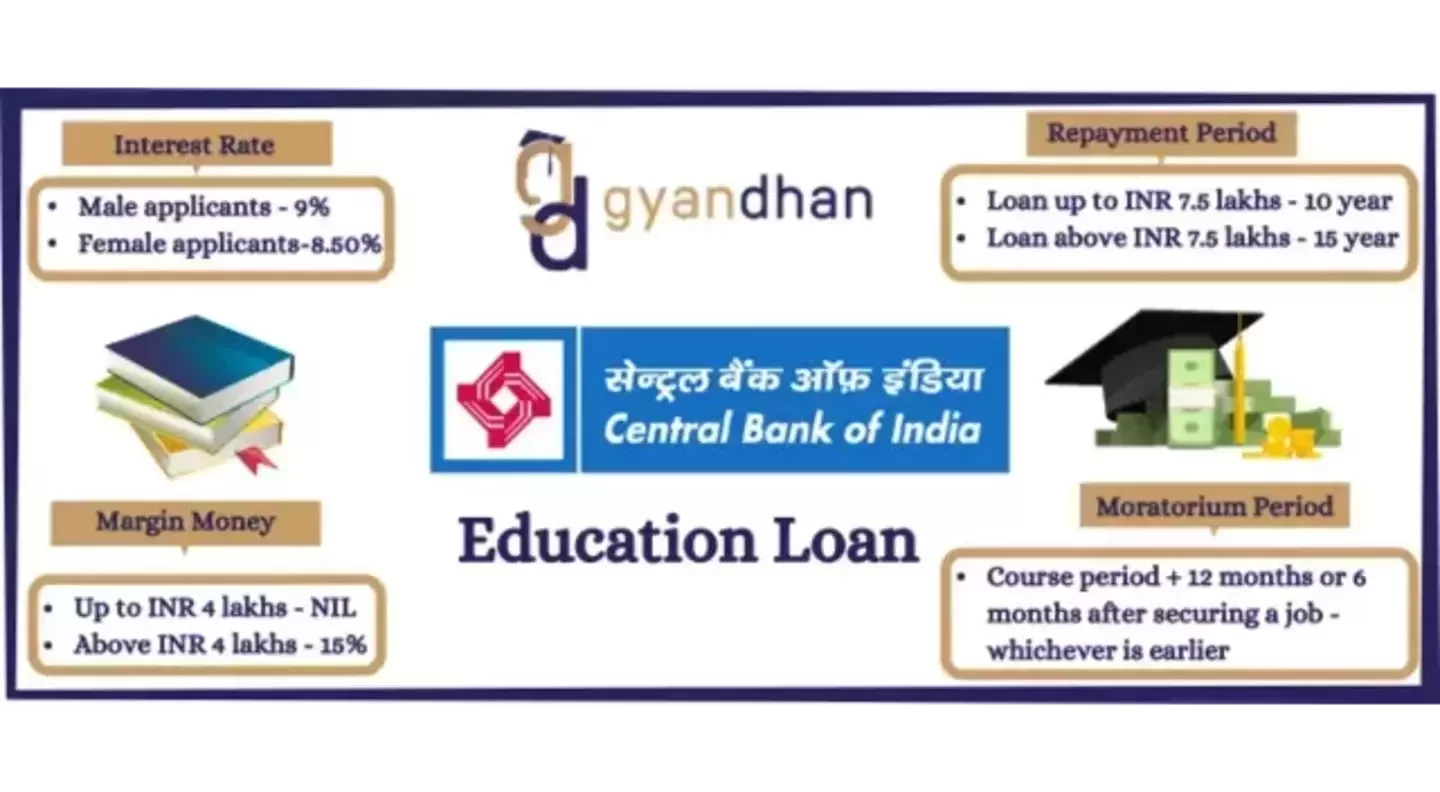

Explore Central Bank of India education loans for studying abroad and in India. Learn about eligibility, interest rates, loan limits, and application process.

The Central Bank of India is a leading public bank in India, set up on 21 December 1911. Central Bank of India, one of India's leading public sector banks, provides education loans to students seeking financial assistance for their higher education pursuits. These loans are designed to cover tuition fees, accommodation charges, exam fees, and other educational expenses, ensuring that deserving students can focus on their studies without financial stress.

Education loan Central Bank of India covers a wide array of educational courses, both in India and abroad. From undergraduate and postgraduate programs to vocational and professional courses, students can receive financial support for a variety of fields.

In today's competitive world, quality education is the cornerstone of personal and professional success. However, the rising costs of education can be a major hurdle for students and their families. To address this challenge and ensure that deserving students can pursue their educational aspirations, the Central Bank of India offers a range of comprehensive education loan schemes.

This education loan Central Bank of India scheme offers education loans for studies in India and abroad.

| Feature | Description |

|---|---|

|

Upto INR 10 Lakh - for studies in India Up to INR 20 Lakh - for studies abroad Up to INR 2 cr - for collateral-based loans |

|

|

9% - 10.30% |

|

|

For studies in India - 5% For studies abroad - 15% |

|

|

Duration of course + 1 year |

|

|

15 years |

|

|

Up to INR 7.5 Lakh - no collateral required Above INR 7.5 Lakh - collateral is required |

|

|

Processing fees |

For studies in India - nil For studies abroad - 15 of the loan amount |

|

Parents or guardian |

Eligibility Criteria:

Central Bank of India education loan for studying MBA in India or abroad.

| Feature | Description |

|---|---|

|

Upto INR 40 Lakh |

|

|

8-10% - 8.20% |

|

|

For studies in India - 5% For studies abroad - 15% |

|

|

Duration of course + 3 months |

|

|

8 - 12 years |

|

|

No collateral required |

|

|

Processing fees |

Nil |

Eligibility Criteria:

| Feature | Description |

|---|---|

|

Upto INR 5000 - INR 1,50,000 |

|

|

11-10% - 11.20% |

|

|

5% |

|

|

3 - 7 years |

|

|

No collateral required |

|

|

Processing fees |

Nil |

Eligibility Criteria:

Central Bank of India education loan cover a wide spectrum of expenses. This list of expenses include the following:

The documents required for education loan in Central Bank of India depend on your profile, your co-applicant’s profile, and any property/asset you may offer as collateral.

Applicant’s documents:

Co-applicant’s documents:

Income proof for salaried co-applicant/guarantor:

Income proof for self-employed co-applicant/guarantor:

Students who are interested in applying for an education loan Central Bank of India must fulfill their set eligibility criteria. There are two ways through which you can apply for a central bank education loan.

If you fail to meet the eligibility requirements set by the Central Bank of India for an education loan, there are multiple options available through both prominent public and private banks, some of which offer loans with or without collateral. Additionally, Non-Banking Financial Companies (NBFCs) can also approve loans for studying abroad within a relatively short period, typically ranging from 7 to 10 days.

One viable solution to secure an abroad education loan without any hassle is through GyanDhan, a leading education loan financing platform. We have established partnerships with an extensive network of banks and NBFCs, providing you with a wider array of loan choices to select from. To start your journey with us, check your loan eligibility and leave the rest to us!

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans

Best Lenders for Education Loan

ICICI Bank

Axis Bank

Union Bank

Prodigy

Auxilo

Credila

IDFC

InCred

MPower

Avanse

SBI

BOB

Poonawalla

Saraswat